SAN MATEO, Calif. - Wednesday, 07. August 2024 AETOSWire

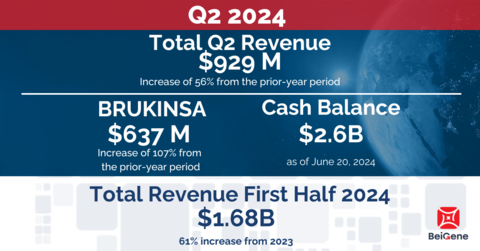

Generated total revenues of $929 million, an increase of 56% from the

prior-year period; reduced GAAP operating loss and achieved non-GAAP

operating income

Strengthened hematology leadership with global

BRUKINSA revenues of $637 million, an increase of 107% from the

prior-year period; advanced pivotal programs for BCL2 inhibitor

sonrotoclax and BTK-targeted degrader BGB-16673

Advanced

innovative solid tumor pipeline of more than 15 investigational

molecules, including ADCs, multispecific antibodies, and targeted

therapies for lung, breast, and gastrointestinal cancers

Strengthened global presence with opening of $800 million, 42-acre

flagship U.S. biologics manufacturing facility and clinical R&D

center in New Jersey and proposal to redomicile from Cayman Islands to

Switzerland, an innovative biotech ecosystem for life sciences leaders

and institutions

(BUSINESS WIRE) -- BeiGene, Ltd.

(NASDAQ: BGNE; HKEX: 06160; SSE: 688235), a global oncology company,

today announced results from the second quarter 2024 and corporate

updates that strengthen the Company for future global growth.

“This

was a tremendous second quarter and an inflection point as BeiGene

achieved positive non-GAAP operating income with rapidly increasing

global revenues and continued financial discipline. Having now reached

this milestone, we will further build on our differentiated, strategic

capabilities as a leading, global oncology innovator,” said John V.

Oyler, Co-Founder, Chairman and CEO of BeiGene. “BRUKINSA is emerging as

the BTKi class leader in the U.S. in new patient starts across all

approved indications, demonstrating the strength of its clinical

efficacy and safety data, and is the only BTKi to demonstrate superior

efficacy versus ibrutinib in a head-to-head trial. With our leadership

in hematology, we are working to expand into other highly prevalent

cancer types, backed by one of the largest oncology research teams in

the industry. With our continued growth in established biopharmaceutical

hubs such as New Jersey and Switzerland, we are better positioned to

reach even more patients with our innovative medicines.”

Financial Highlights

(Amounts in thousands of U.S. dollars)

Three Months Ended June 30,

Six Months Ended June 30,

(in thousands, except percentages)

2024

2023

% Change

2024

2023

% Change

Net product revenues

$

921,146

$

553,745

66

%

$

1,668,064

$

964,036

73

%

Net revenue from collaborations

$

8,020

$

41,516

(81

)%

$

12,754

$

79,026

(84

)%

Total Revenue

$

929,166

$

595,261

56

%

$

1,680,818

$

1,043,062

61

%

GAAP loss from operations

$

(107,161

)

$

(318,715

)

(66

)%

$

(368,509

)

$

(689,973

)

(47

)%

Adjusted income(loss) from operations*

$

48,464

$

(193,051

)

125

%

$

(98,877

)

$

(468,910

)

(79

)%

*

For an explanation of our use of non-GAAP financial measures refer to

the "Use of Non-GAAP Financial Measures" section later in this press

release and for a reconciliation of each non-GAAP financial measure to

the most comparable GAAP measures, see the table at the end of this

press release.

Key Business Updates

BRUKINSA® (zanubrutinib)

U.S. sales of BRUKINSA totaled $479 million in the second quarter of

2024, representing growth of 114% over the prior-year period, with more

than 60% of the quarter over quarter demand growth coming from expanded

use in CLL as BRUKINSA continued to gain share in CLL new patient

starts; BRUKINSA sales in Europe totaled $81 million in the second

quarter of 2024, representing growth of 209%, driven by increased market

share across all major markets, including Germany, Italy, Spain, France

and the UK;

Presented data from Arm D of the Phase 3 SEQUOIA

trial evaluating BRUKINSA in combination with venetoclax in

treatment-naïve (TN) patients with high-risk CLL and/or small

lymphocytic lymphoma (SLL) with del(17p) and/or TP53 mutation as an oral

presentation at the European Hematology Association (EHA) 2024 Hybrid

Congress; preliminary data demonstrated an overall response rate of 100%

in 65 response-evaluable patients and a rate of complete response (CR)

plus CR with incomplete hematopoietic recovery (CRi) of 48%; and

Presented new analyses highlighting improved progression free survival

and response rates and a low usage of antihypertensive medicines for

patients treated with BRUKINSA compared to other Bruton’s tyrosine

kinase inhibitors (BTKis) used to treat CLL/SLL, including acalabrutinib

and ibrutinib at the American Society of Clinical Oncology (ASCO)

Annual Meeting and EHA.

TEVIMBRA® (tislelizumab)

Sales

of tislelizumab totaled $158 million in the second quarter of 2024,

representing growth of 6% compared to the prior-year period;

Presented new data from the Phase 3 RATIONALE-306 study evaluating

TEVIMBRA plus chemotherapy in patients with advanced or metastatic

esophageal squamous cell carcinoma (ESCC) at ASCO; and

Received an update that the U.S. Food and Drug Administration (FDA) has

deferred approval for tislelizumab in first-line unresectable,

recurrent, locally advanced, or metastatic ESCC with a target PDUFA

action date of July 2024 on account of a delay in scheduling clinical

site inspections.

Key Pipeline Highlights

Hematology

Sonrotoclax (BCL2 inhibitor)

More than 1,000 patients enrolled to date across the program;

Completed enrollment in global Phase 2 trial in R/R mantle cell

lymphoma (MCL) and continued enrollment in global Phase 2 trial in

Waldenström’s macroglobulinemia (WM) and China-only Phase 2 trial in R/R

CLL, all with registrational intent, as well as continued enrollment in

global Phase 3 CELESTIAL trial in combination with BRUKINSA in TN CLL;

At EHA 2024, presented data highlighting deep and durable responses

with tolerable safety profile in Phase 1 studies in combination with

BRUKINSA in R/R CLL/SLL and R/R MCL as well as results of additional

Phase 1 trials demonstrating encouraging response rates, durable

responses and manageable safety profiles as monotherapy in R/R WM, in

combination with azacitidine in both TN and R/R acute myeloid leukemia,

and in combination with dexamethasone in R/R multiple myeloma harboring

translocation (11;14);

Received FDA fast track designation for R/R WM; and

Anticipating first subjects enrolled in Phase 3 programs in R/R CLL and

R/R MCL in the fourth quarter of 2024 or first quarter of 2025.

BGB-16673 (BTK CDAC)

More than 300 patients enrolled to date across the program; continued

to enroll potentially registration enabling expansion cohorts in R/R MCL

and R/R CLL; and

At EHA 2024, presented data highlighting

promising preliminary efficacy and safety in patients with R/R CLL/SLL;

anticipating first subject enrolled in Phase 3 program in fourth quarter

of 2024 or first quarter of 2025.

Solid Tumors

Lung Cancer

Multiple randomized tislelizumab lung cancer combination cohorts with

BGB-A445 (anti-OX40), LBL-007 (anti-LAG3) and BGB-15025 (HPK1 inhibitor)

expected to read out in 2024;

BGB-C354 (B7H3 ADC): Initiated dose escalation for the Company’s first internally developed ADC;

BGB-R046 (IL-15 prodrug): Initiated dose escalation; this is a cytokine

prodrug, leveraging protease-dependent release of active IL-15 in the

tumor microenvironment and eliciting anti-tumor activity by promoting T

and natural killer (NK) cell expansion; and

Pan-KRAS,

MTA-cooperative PRMT5 inhibitors and EGFR CDAC targeted protein degrader

on track to enter the clinic in the second half of 2024.

Breast and Gynecologic Cancers

BGB-43395 (CDK4 inhibitor): Continued dose escalation in monotherapy

and in combination with fulvestrant and letrozole in the anticipated

efficacious dose range with no dose limiting toxicities observed; more

than 60 patients enrolled to date across the program; potential to share

first readout of Phase 1 data in the fourth quarter of 2024; and

BG-68501 (CDK2 inhibitor) and BG-C9074 (B7H4 ADC): Continued

monotherapy dose escalation, with pharmacokinetics as expected and no

dose limiting toxicities observed.

Gastrointestinal Cancers

Tislelizumab combination cohorts with LBL-007 (anti-LAG3) in ESCC reading out in 2024;

BLA accepted by the NMPA for zanidatamab for the treatment of second-line biliary tract cancer; and

CEA ADC, FGFR2b ADC and GPC3x4-1BB bispecific antibody on track to enter the clinic in the second half of 2024.

Immunology & Inflammation

Initiated clinical development of BGB-43035 (IRAK4 CDAC) with potential

to induce deeper and faster IRAK4 degradation with stronger cytokine

inhibition than competitors; this is the second targeted degrader from

the Company’s proprietary CDAC platform.

Corporate Updates

Opened flagship U.S. biologics manufacturing facility and clinical

R&D center at the Princeton West Innovation Campus in Hopewell,

N.J.; the facility includes 400,000 square feet of dedicated

manufacturing space; and

Announced intent to change

jurisdiction of incorporation from the Cayman Islands to Basel,

Switzerland, enabling the Company to deepen its roots in a global

biopharmaceutical hub as it further executes on its global growth

strategy to reach more patients around the world with its innovative

medicines; this redomiciliation is subject to shareholder approval.

Second Quarter 2024 Financial Highlights

Revenue

for the three months ended June 30, 2024, was $929 million, compared to

$595 million in the same period of 2023, driven primarily by growth in

BRUKINSA product sales in the U.S. and Europe of 114% and 209%

respectively.

Product Revenue for the three months ended June 30,

2024, was $921 million, compared to $554 million in the same period of

2023, representing an increase of 66%. The increase in product revenue

was primarily attributable to increased sales of BRUKINSA. For the three

months ended June 30, 2024, the U.S. was the Company’s largest market,

with product revenue of $479 million, compared to $224 million in the

prior year period. In addition to BRUKINSA revenue growth, product

revenues were positively impacted by sales of in-licensed products from

Amgen in China and tislelizumab.

Gross Margin as a percentage of

global product revenue for the second quarter of 2024 was 85%, compared

to 83% in the prior-year period. The gross margin percentage increased

primarily due to proportionally higher sales mix of global BRUKINSA

compared to other products in the portfolio.

Operating Expenses

The following table summarizes operating expenses for the second quarter 2024 and 2023, respectively:

GAAP

Non-GAAP

(in thousands, except percentages)

Q2 2024

Q2 2023

% Change

Q2 2024

Q2 2023

%

Research and development

$

454,466

$

422,764

7

%

$

382,509

$

363,735

5

%

Selling, general and administrative

$

443,729

$

395,034

12

%

$

363,922

$

331,607

10

%

Amortization

$

—

$

188

(100

)%

$

—

$

—

NM

Total operating expenses

$

898,195

$

817,986

10

%

$

746,431

$

695,342

7

%

The following table summarizes operating expenses for the first half 2024 and 2023, respectively:

GAAP

Non-GAAP

(in thousands, except percentages)

Q2 YTD 2024

Q2 YTD 2023

% Change

Q2 YTD 2024

Q2 YTD 2023

% Change

Research and development

$

915,104

$

831,348

10

%

$

787,949

$

725,431

9

%

Selling, general and administrative

$

871,156

$

723,533

20

%

$

736,068

$

614,761

20

%

Amortization

$

—

$

375

(100

)%

$

—

$

—

NM

Total operating expenses

$

1,786,260

$

1,555,256

15

%

$

1,524,017

$

1,340,192

14

%

Research

and Development (R&D) Expenses increased for the second quarter of

2024 compared to the prior-year period on both a GAAP and adjusted basis

primarily due to advancing preclinical programs into the clinic and

early clinical programs into late stage. Upfront fees and milestone

payments related to in-process R&D for in-licensed assets totaled

$12 million in the second quarter of 2024, compared to nil in the

prior-year period.

Selling, General and Administrative (SG&A)

Expenses increased for the second quarter of 2024 compared to the

prior-year period on both a GAAP and adjusted basis due to continued

investment in the global commercial launch of BRUKINSA, primarily in the

U.S. and Europe. SG&A expenses as a percentage of product sales

were 48% for the second quarter of 2024 compared to 71% in the prior

year period.

Income (Loss) from Operations in the second quarter

of 2024 operating loss decreased 66% on a GAAP basis. On an adjusted

basis, we achieved operating income of $48 million. The decrease in GAAP

operating loss and achievement of profitability on an adjusted basis is

a key strategic goal and the result of tremendous efforts to drive

growth while maintaining investment discipline.

GAAP Net Loss

improved for the quarter ended June 30, 2024, compared to the prior-year

period, as our product revenue growth and management of expenses is

driving increased operating leverage.

For the quarter ended June

30, 2024, net loss per share were $(0.09) and $(1.15) per American

Depositary Share (ADS), compared to $(0.28) per share and $(3.64) per

ADS in the prior year period.

Cash Used in Operations for the

quarter ended June 30, 2024, totaled $96 million compared to $294

million in the prior-year period, driven by improved operating leverage.

For

further details on BeiGene’s Second Quarter 2024 Financial Statements,

please see BeiGene’s Quarterly Report on Form 10-Q for the second

quarter of 2024 filed with the U.S. Securities and Exchange Commission.

About BeiGene

BeiGene

is a global oncology company that is discovering and developing

innovative treatments that are more affordable and accessible to cancer

patients worldwide. With a broad portfolio, we are expediting

development of our diverse pipeline of novel therapeutics through our

internal capabilities and collaborations. We are committed to radically

improving access to medicines for far more patients who need them. Our

growing global team of more than 10,000 colleagues spans five

continents. To learn more about BeiGene, please visit www.beigene.com

and follow us on LinkedIn, X (formerly known as Twitter) and Facebook.

Forward-Looking Statements

This

press release contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995 and other federal

securities laws, including statements regarding BeiGene’s potential to

further emerge as a leading, global oncology innovator; BeiGene’s

ability to expand into other highly prevalent cancer types; BeiGene’s

preliminary clinical data and activities, as well as anticipated read

outs; whether shareholders will approve BeiGene’s change in jurisdiction

of incorporation and if approved, whether this change will enable

BeiGene to further execute on its global growth strategy; and BeiGene’s

plans, commitments, aspirations and goals under the caption “About

BeiGene”. Actual results may differ materially from those indicated in

the forward-looking statements as a result of various important factors,

including BeiGene’s ability to demonstrate the efficacy and safety of

its drug candidates; the clinical results for its drug candidates, which

may not support further development or marketing approval; actions of

regulatory agencies, which may affect the initiation, timing and

progress of clinical trials and marketing approval; BeiGene’s ability to

achieve commercial success for its marketed medicines and drug

candidates, if approved; BeiGene's ability to obtain and maintain

protection of intellectual property for its medicines and technology;

BeiGene’s reliance on third parties to conduct drug development,

manufacturing, commercialization, and other services; BeiGene’s limited

experience in obtaining regulatory approvals and commercializing

pharmaceutical products; BeiGene’s ability to obtain additional funding

for operations and to complete the development of its drug candidates

and achieve and maintain profitability; and those risks more fully

discussed in the section entitled “Risk Factors” in BeiGene’s most

recent quarterly report on Form 10-Q, as well as discussions of

potential risks, uncertainties, and other important factors in BeiGene’s

subsequent filings with the U.S. Securities and Exchange Commission.

All information in this press release is as of the date of this press

release, and BeiGene undertakes no duty to update such information

unless required by law.

Condensed Consolidated Statements of Operations (U.S. GAAP)

(Amounts in thousands of U.S. dollars, except for shares, American Depositary Shares (ADSs), per share and per ADS data)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

(Unaudited)

(Unaudited)

Revenues

Product revenue, net

$

921,146

$

553,745

$

1,668,064

$

964,036

Collaboration revenue

8,020

41,516

12,754

79,026

Total revenues

929,166

595,261

1,680,818

1,043,062

Cost of sales - products

138,132

95,990

263,067

177,779

Gross profit

791,034

499,271

1,417,751

865,283

Operating expenses:

Research and development

454,466

422,764

915,104

831,348

Selling, general and administrative

443,729

395,034

871,156

723,533

Amortization of intangible assets

—

188

—

375

Total operating expenses

898,195

817,986

1,786,260

1,555,256

Loss from operations

(107,161

)

(318,715

)

(368,509

)

(689,973

)

Interest income, net

13,225

15,070

29,385

31,086

Other expense, net

(11,984

)

(63,818

)

(10,222

)

(45,515

)

Loss before income taxes

(105,920

)

(367,463

)

(349,346

)

(704,402

)

Income tax expense

14,485

13,674

22,209

25,166

Net loss

(120,405

)

(381,137

)

(371,555

)

(729,568

)

Net loss per share, basic and diluted

$

(0.09

)

$

(0.28

)

$

(0.27

)

$

(0.54

)

Weighted-average shares outstanding—basic and diluted

1,361,082,567

1,360,224,377

1,358,315,145

1,357,211,308

Net loss per ADS, basic and diluted

$

(1.15

)

$

(3.64

)

$

(3.56

)

$

(6.99

)

Weighted-average ADSs outstanding—basic and diluted

104,698,659

104,632,644

104,485,780

104,400,870

Select Condensed Consolidated Balance Sheet Data (U.S. GAAP)

(Amounts in thousands of U.S. Dollars)

As of

June 30,

December 31,

2024

2023

(unaudited)

(audited)

Assets:

Cash, cash equivalents, and restricted cash

$

2,617,931

$

3,185,984

Accounts receivable, net

529,449

358,027

Inventories

443,260

416,122

Property, plant and equipment, net

1,516,491

1,324,154

Total assets

5,712,179

5,805,275

Liabilities and equity:

Accounts payable

333,022

315,111

Accrued expenses and other payables

646,538

693,731

R&D cost share liability

203,627

238,666

Debt

1,036,928

885,984

Total liabilities

2,345,924

2,267,948

Total equity

$

3,366,255

$

3,537,327

Note Regarding Use of Non-GAAP Financial Measures

BeiGene

provides certain non-GAAP financial measures, including Adjusted

Operating Expenses and Adjusted Operating Loss and certain other

non-GAAP income statement line items, each of which include adjustments

to GAAP figures. These non-GAAP financial measures are intended to

provide additional information on BeiGene’s operating performance.

Adjustments to BeiGene’s GAAP figures exclude, as applicable, non-cash

items such as share-based compensation, depreciation and amortization.

Certain other special items or substantive events may also be included

in the non-GAAP adjustments periodically when their magnitude is

significant within the periods incurred. BeiGene maintains an

established non-GAAP policy that guides the determination of what costs

will be excluded in non-GAAP financial measures and the related

protocols, controls and approval with respect to the use of such

measures. BeiGene believes that these non-GAAP financial measures, when

considered together with the GAAP figures, can enhance an overall

understanding of BeiGene’s operating performance. The non-GAAP financial

measures are included with the intent of providing investors with a

more complete understanding of the Company’s historical and expected

financial results and trends and to facilitate comparisons between

periods and with respect to projected information. In addition, these

non-GAAP financial measures are among the indicators BeiGene’s

management uses for planning and forecasting purposes and measuring the

Company’s performance. These non-GAAP financial measures should be

considered in addition to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP. The non-GAAP

financial measures used by the Company may be calculated differently

from, and therefore may not be comparable to, non-GAAP financial

measures used by other companies.

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES

(in thousands, except per share amounts)

(unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

(in thousands)

(in thousands)

Reconciliation of GAAP to adjusted cost of sales - products:

GAAP cost of sales - products

$

138,132

$

95,990

$

263,067

$

177,779

Less: Depreciation

2,684

2,180

5,029

4,360

Less: Amortization of intangibles

1,177

840

2,360

1,639

Adjusted cost of sales - products

$

134,271

$

92,970

$

255,678

$

171,780

Reconciliation of GAAP to adjusted research and development:

GAAP research and development

$

454,466

$

422,764

$

915,104

$

831,348

Less: Share-based compensation cost

55,406

45,948

93,451

79,976

Less: Depreciation

16,551

13,081

33,704

25,941

Adjusted research and development

$

382,509

$

363,735

$

787,949

$

725,431

Reconciliation of GAAP to adjusted selling, general and administrative:

GAAP selling, general and administrative

$

443,729

$

395,034

$

871,156

$

723,533

Less: Share-based compensation cost

75,288

57,381

125,957

98,741

Less: Depreciation

4,519

6,046

9,131

10,031

Adjusted selling, general and administrative

$

363,922

$

331,607

$

736,068

$

614,761

Reconciliation of GAAP to adjusted operating expenses

GAAP operating expenses

$

898,195

$

817,986

$

1,786,260

$

1,555,256

Less: Share-based compensation cost

130,694

103,329

219,408

178,717

Less: Depreciation

21,070

19,127

42,835

35,972

Less: Amortization of intangibles

—

188

—

375

Adjusted operating expenses

$

746,431

$

695,342

$

1,524,017

$

1,340,192

Reconciliation of GAAP to adjusted income (loss) from operations:

GAAP loss from operations

$

(107,161

)

$

(318,715

)

$

(368,509

)

$

(689,973

)

Plus: Share-based compensation cost

130,694

103,329

219,408

178,717

Plus: Depreciation

23,754

21,307

47,864

40,332

Plus: Amortization of intangibles

1,177

1,028

2,360

2,014

Adjusted income (loss) from operations

$

48,464

$

(193,051

)

$

(98,877

)

$

(468,910

)

View source version on businesswire.com: https://www.businesswire.com/news/home/20240807337131/en/

Permalink

https://www.aetoswire.com/en/news/0708202440767

Contacts

Investor Contact

Liza Heapes

+1 857-302-5663

ir@beigene.com

Media Contact

Kyle Blankenship

+1 667-351-5176

media@beigene.com

No comments:

Post a Comment